It’s clear that cap rates for long-term, GSA-leased properties have fallen steadily since the end of the 2008 recession. Yet, we’ve been challenged to demonstrate that in a meaningful way. The problem is that merely reporting government-leased property sales doesn’t show much correlation between cap rates and the march of time. This is largely because federal properties tend to not be very homogenous. They are often purpose-built facilities, perhaps mission critical, with unique design or locational attributes that dramatically impact valuation. Often the “story” behind the facility and the perceived residual value at the end of the lease term are the primary determinants of value. Remaining lease term, of course, is also critically important.

It’s clear that cap rates for long-term, GSA-leased properties have fallen steadily since the end of the 2008 recession. Yet, we’ve been challenged to demonstrate that in a meaningful way. The problem is that merely reporting government-leased property sales doesn’t show much correlation between cap rates and the march of time. This is largely because federal properties tend to not be very homogenous. They are often purpose-built facilities, perhaps mission critical, with unique design or locational attributes that dramatically impact valuation. Often the “story” behind the facility and the perceived residual value at the end of the lease term are the primary determinants of value. Remaining lease term, of course, is also critically important.

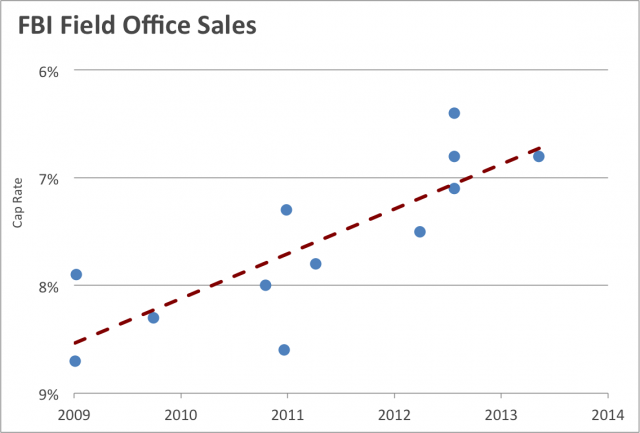

As a result, simply reporting sale comps in a time series doesn’t really tell us much about underlying investor sentiment. So, we decided to try to solve for some of these variables by looking only at a subset of federal properties. We chose FBI field offices. More than two dozen of these buildings have been constructed since 9/11, part of the largest lease-construct program in our nation’s history. The program actually started after the 1995 Murrah Building bombing in Oklahoma City. Following that devastating act of domestic terrorism, FBI evaluated all of its U.S. facilities, including its 56 field offices. The Bureau set out to consolidate these facilities, improve their function to accommodate FBI’s growing mission and establish far better security.

The result is a fairly standard design template that has been applied to almost three dozen new leased field offices since 1995. The basic format is a Class A office building with an adjoining vehicle maintenance facility and substantial parking, usually in a structured garage. All of this resides on a parcel of land large enough to provide a minimum 100′ standoff distance to the secured perimeter. The design must also accommodate modest expansion of the facility.

Many of these field offices have traded since they were completed, providing enough data for semi-empirical analysis. We discarded sales with less than 10 years of remaining lease term and we also excluded sales of field offices that didn’t conform to the format described above. We were left with 12 sales to analyze and the trend in that subset is pretty clear: cap rates have fallen roughly 175 bps. Much of this has been driven by declining interest rates and some of it also by a recovering economy, but we think a substantial factor is that “safe harbor” investments like long-term leased FBI field offices are in increasing demand.

UPDATE: This trend has been updated here.