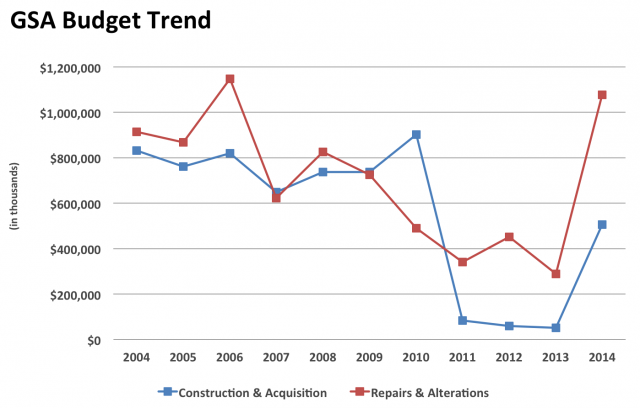

We’ve often said on this blog that you need only look at GSA’s budget as the bellwether for leasing demand. In recent years we’ve noted that budget reductions imposed by Congress have put GSA in a position where its owned inventory suffered and demand for leased space was buttressed. Despite the agency’s stated goal of reducing reliance on “costly leasing” there has been little funding available for upgrade of federal buildings to accommodate additional tenancy.

Now that may be changing. After suffering three years of historically constrained spending at the hands of Congress, GSA has received a little wiggle room. Let’s be clear: this year’s appropriated funds aren’t sufficient for watershed change but they are enough for the agency to move forward more quickly with its strategic initiatives to reduce the footprint and begin shifting into owned space. This prospect isn’t appealing to private-sector property owners.

So, what can lessors expect?

1. GSA will remain as cautious as ever. The détente established with Congress can easily be unraveled. The agency is just one false move from a return to the fiscal doghouse. If you’ve been frustrated with the maddeningly “deliberate” pace of GSA decision making, get used to it.

2. Wherever possible, GSA will seek to shift personnel into owned facilities and it will seek to downsize space. It will do this even in instances where it arguably doesn’t make financial sense for the tenant agency. Downsizing and elimination of “costly” leased space are the primary metrics that matter at GSA and on the Hill.

3. Long term, non-cancellable leases will remain difficult to come by. Yes, in some cases budget clarity will give agencies the green light to enter into long-term deals but we’ll also see agencies seek flexibility to enable future consolidations or relocations to owned space. Lessors will be frustrated by this because those future consolidation/relocation projects will often be purely aspirational, with no concrete plan behind them. It’s a different type of kicking the can.

4. In the event that tenants do embark on long-term leases, they will more often seek to improve space efficiency in conjunction with downsizing or consolidation. This will typically require substantial reconstruction of existing space that erodes the incumbent Lessor’s pricing advantage. In fact, it’s an outright disadvantage in those instances where swing space and phasing is required. Therefore, federal tenants will become more mobile, and renewal probabilities–especially among buildings with less efficient space build-outs–should decline. It will require a lot more planning to execute successful renewals.

GSA’s budget isn’t sufficient to cause immediate radical change and agencies will continue to resist huge lump-sum expenditures for relocation and replication of space, but we already see the above trends percolating in markets across the United States. If the federal budget continues to stabilize and GSA further funds programs like Total Workplace (which finances furniture and IT costs) we are certain to see continued downsizing in the leased inventory. The budget drives all of this.