Several times on this blog I’ve observed that GSA has been engaged in a spirited game of can-kicking when it comes to leasing. Much of this has been due to intense budget distress from record deficits, rising debt, the sequester, and a series of continuing resolutions, all cast against a backdrop of hopeless political dysfunction. Without long-term clarity of funding or mission, federal agencies have shifted into triage mode resulting in an increasing number of short-term extensions and holdovers. In a study last year we looked at leases due to expire between June 2012 and June 2013 and found that 42% of them were extended for three years or less (this is net of leases that were already in holdover).

Several times on this blog I’ve observed that GSA has been engaged in a spirited game of can-kicking when it comes to leasing. Much of this has been due to intense budget distress from record deficits, rising debt, the sequester, and a series of continuing resolutions, all cast against a backdrop of hopeless political dysfunction. Without long-term clarity of funding or mission, federal agencies have shifted into triage mode resulting in an increasing number of short-term extensions and holdovers. In a study last year we looked at leases due to expire between June 2012 and June 2013 and found that 42% of them were extended for three years or less (this is net of leases that were already in holdover).

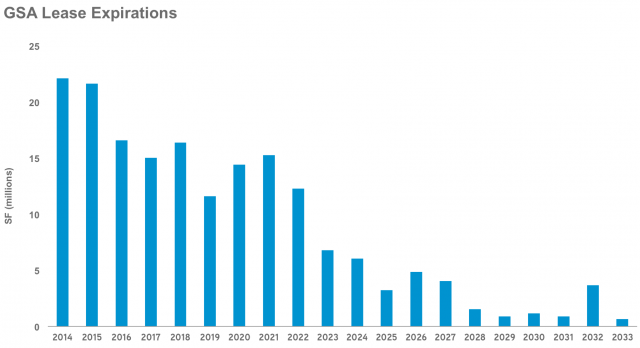

These ever-shorter extensions have created a “pile up” of lease expirations such that now one-quarter of all GSA leases are due to expire this year and next. We are talking about almost 44 MSF of leases (net of several million square feet of holdovers) teetering on the verge of expiration. Worse yet, currently 52 MSF of leases are in their soft term*. The situation creates opportunity and peril for both GSA and for lessors. Let’s look at the plight of each.

Opportunity and Peril for the Government

When it comes to the issue of real estate spending reduction, there is rare bipartisan agreement. Both Congress and the White House are clear on the goals: freeze the footprint, reduce costs and improve space utilization. These are the only three metrics of political importance. Regarding the huge volume of upcoming lease expirations, Rep. Lou Barletta, in his first hearing as the new chair of the Economic Development, Public Buildings and Emergency Management Subcommittee, observed that “we don’t want to miss this opportunity” to quickly reduce real estate costs and inventory.

From the government’s standpoint, this really is a unique time to quickly achieve its space reduction goals, yet GSA has been challenged to accomplish on-time completion of even the “normal” amount of leasing. In most years, some portion of leases simply don’t get done and they are either extended for a short period or they lapse into holdover. In order to execute the next generation of leases GSA will need to coordinate with its tenant agencies to plan consolidation, realignment and space reconfiguration. Each such project is a difficult and time consuming exercise and we can expect that thoughtful efforts could take years to execute. That means there will continue to be many more short term leases and, frankly, more burden on GSA.

In last year’s fiscal environment GSA’s task was clearly futile. This year feels more promising in the wake of the Ryan-Murray budget agreement and subsequent appropriations. Yet, more progress must made before agencies feel emboldened to commit to major lump-sum expenditures for space reconfiguration.

Opportunity and Peril for Lessors

The federal government’s reluctance to execute long, firm-term transactions has made them largely captive. Short-term extensions have enabled lessors to maintain occupancy with very little capital input, and higher rents are often achieved in compensation for these extensions. So, purely on a current yield basis, GSA’s plight can provide a financial benefit.

However, for many lessors short-term extensions are nothing more than a consolation prize. These days, lease term–firm term–is critically important. It is a prerequisite to refinancing or creating dispositions value. In some circumstances the cash flow from extensions is merely swept by the lender.

Based on the (hopeful) assumption that the federal government will eventually return to a more normal long-term leasing approach, we can expect a new set of challenges for lessors. Where agencies ultimately seek to downsize or dramatically reconfigure their space, incumbent lessors could find themselves at a disadvantage. Executing renewals in those circumstances can require phased renovation, swing space and other logistical complications. GSA won’t always be willing to entertain this complexity, structuring its procurements to favor the “blank canvas” offered by competing vacant buildings.

The business of leasing space to the federal government has become more demanding. Terrific opportunities remain but successful investment more often requires greater diligence and hands-on asset management.

* We use “soft term” to describe the portion of lease term where the government has a termination right. This is typically structured as a rolling termination right and is (unfortunately) quite common in GSA leases.

UPDATE: We’ve discovered one more big contributor to the “pile-up”. Click here.