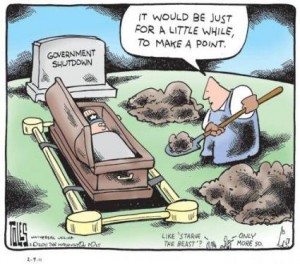

Through all of the partisan dysfunction our nation has endured in recent years, the federal budgeting process nonetheless managed to stagger along. Until October 1st. Then the U.S. Government experienced its first shutdown since 1995.

Through all of the partisan dysfunction our nation has endured in recent years, the federal budgeting process nonetheless managed to stagger along. Until October 1st. Then the U.S. Government experienced its first shutdown since 1995.

The event was bracing because we have come to view partisan discord and 11th-hour negotiations as part of the federal government’s “new normal”. It was unusual to see the deadline pass without agreement.

Then the phones began to ring. Property owners wanted to know what the shutdown would mean, primarily for the government’s ability to pay rent and reimbursements. The answers, which we posted here on this blog, surprised many–even us. To begin, a shutdown occurs specifically because Congress does not pass an appropriations bill or a Continuing Resolution. These appropriations are necessary to fund discretionary spending, which includes payment of rent. Therefore, the most obvious lesson learned from the shutdown is that payment on contracts is not automatic. Yet, in this article we have considered some broader implications as well.

Lesson #1: Even GSA rent is subject to congressional appropriations

The Shutdown has taught us that rent–even GSA-paid rent–is fundamentally subject to annual appropriations. This is true even though the monies exist in the Federal Buildings Fund because congressional appropriations are required to move those monies out of the Fund. In fact, all discretionary federal spending is subject to congressional appropriations. Some agencies that lease space directly (i.e. not through GSA) may be exempt if their rent payments have been previously appropriated through multi-year or “no year” funds obligated for the life of the lease or some portion thereof, without regard for fiscal year limitations. But those situations are fairly rare.

As a practical matter, a shutdown would need to be ill-timed or historically lengthy to disrupt rent payments since the federal government pays rent in arrears (i.e. at the end of the month, not the beginning). This last shutdown, for example, ended well before the end of the month, allowing GSA time to queue up its payments, which are made by electronic funds transfer. However, some items, such as operating cost reimbursements, were probably delayed since they require “human” entry into GSA’s lease administration system by the middle of the month.

Lesson #2: Future shutdowns can be expected

There have been 18 past shutdowns and they seem to arrive in spurts. If history is any guide, there will be others, even if they last only a day or two. Anticipating continued fiscal brinksmanship, we expect federal agencies to further retrench. Not knowing what their budget may be for any more than a few weeks or months into the future, many federal agencies will take the safe route when it comes to contracting: short-term, low cost (i.e. low TI contribution) lease extensions. Big plans for consolidation–even where the savings could be substantial–will generally have to wait, unless the private sector will pick up the lump sum costs.

As it turns out, that could happen in some instances. Market conditions are generally soft right now and some lessors are willing to contribute substantial capital and abatement to attract long-term deals. Yet, even then, its likely that some financial burden will fall on the agencies. Furniture costs, for example, cannot be amortized into rent–they must be paid separately*. It’s a shame for the federal government because its best opportunity to achieve real estate cost savings is to execute long term leases, yet those are exactly the types of transactions agencies will be most resistant to pursue. It’s a triage mindset.

Lesson #3: Exiting your government-leased investment will be more difficult

Property owners are now seeing that exiting their government-leased property investment has become a lot more difficult. Because of the can-kicking, average lease terms are growing ever-shorter and, more significantly, long-term leases are very rare. Two quick stats support this observation:

1) In a recent analysis of 75,000+ SF leases, we found that only 73 of these had remaining total term (without regard for cancellation rights) of more than 10 years. That is 73 leases out of roughly 8,700 total leases in GSA’s lease inventory.

2) We conducted an analysis of GSA leases scheduled to expire over the past year to see what happened to them. We found that more than 40% of these extended for 3 years or less.

The good news for lessors is that short-term extensions offer a near-certain probability of tenant retention, typically at high-yielding rent structures. The bad news, of course, is that in this investment market valuation is far more influenced by term than rent.

Lesson #4: The credit of the United States government remains in jeopardy.

The 2011 debt ceiling standoff spooked Standard & Poor’s to the point that it issued an historic downgrade of U.S. debt securities from AAA to AA+. Since then, both Moody’s and Fitch have expressed concern over U.S. credit. The threat of further downgrades does not reflect a lack of confidence in the nation’s balance sheet but, rather, anxiety caused by “political brinksmanship”. In its 2011 press release, S&P noted that “the statutory debt ceiling and the threat of default have become political bargaining chips in the debate over fiscal policy.” Moody’s and Fitch share the same view and both issued a “negative” outlook on U.S. debt following the 2011 event (though Moody’s, surprisingly, shifted its outlook back to “stable” in July, despite the recent debt ceiling battle).

If future debt ceiling discussions continue to roll up to the lip of the abyss, what triple-A bond holder needs this worry? It’s likely that Fitch and/or Moody’s will finally follow S&P’s lead with downgrades of their own.

2014 will host a mid-term election and continued tax and spending debate is likely to pre-occupy Congress for most of the year. The chance of another shutdown seems high, despite promises of “never again” by ranking members of both parties. Be prepared.

*GSA’s Total Workplace initiative may help agencies partially overcome the problem of lump sum expenditures. Total Workplace was created to help agencies implement improved space utilization. One important feature of the program is the ability of GSA’s Federal Acquisition Service to “finance” agencies’ furniture purchases and information technology costs that are not funded through the tenant improvement allowance. However, the program will not pay for relocation expenses.