“Clearly this is not a Grand Bargain but it was never meant to be. It was designed to create some bipartisan agreement and some momentum.” – Rep. Paul Ryan

On December 26th, President Obama signed the Bipartisan Budget Act of 2013 (BBA) into law. Now many are asking whether this event is meaningful for federal leasing. The quick answer is “sort of” because, like many things relating to federal real estate, the complete answer is not so simple or clear.

First, Some Background…

Even on an inflation-adjusted basis the federal government has been racking up historic deficits. In the past five years, these deficits have averaged more than $1 trillion annually. As a result, the gross federal debt has increased $7 trillion. It now totals more than $17.2 trillion, which is more than 100% of GDP.*

Deficits and rising debt spawned the tea-party movement and in 2010 a large cadre of these fiscal conservatives were elected into the House of Representatives allowing Republicans to assume majority control of that chamber. Soon thereafter, partisan brinksmanship displayed over raising the debt ceiling caused the first ever downgrade of US credit by S&P. That debt ceiling battle was ultimately resolved by passage of the Budget Control Act, which established a supercommittee to resolve partisan differences in tax and spending. Yet, the failure of the supercommittee led to the $1.2 trillion dollar sequester.

Along the way, Congress has not passed a single omnibus appropriations bill since 2009. Instead, the federal government has limped along under a series of short-term continuing resolutions. Then, as of October 1st of this year, the Congress could not even agree to a continuing resolution so we were treated to our first government shutdown in nearly two decades.

Through all of this, the hapless federal agencies have been engaged in triage. Without any certainty to their long-term mission or budget they have been left to simply kick the can with short term lease extensions. And kick the can they have. Our analysis of leases expiring in the last year shows that more than 40% were extended three years or less. The average remaining lease term in GSA’s portfolio has grown ever-shorter and now there is such an astonishing pile-up of lease expirations that one-fourth of all GSA leases are scheduled to expire in the next two years.

The government’s inability to commit to long-term lease contracts has been troubling for lessors faced with loan maturities, and the short-term leases have substantially eroded the exit valuations of government-leased properties. For agencies, short-term extensions have prevented them from implementing space redesigns to achieve greater efficiency in compliance with Freeze The Footprint mandates. The short-term leases have also generally been more costly, reflecting the limited competition available to accommodate them.

The Deal

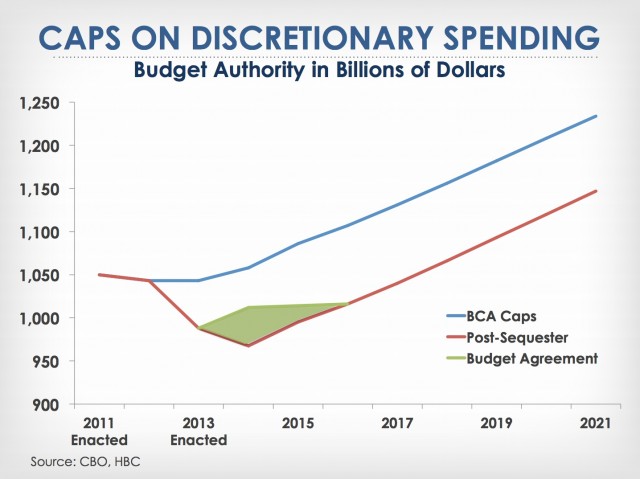

In the context of this troubling backdrop, the BBA offers some encouragement but let’s be clear: this is a small deal. The Act is programmed to provide $62 billion in temporary sequester relief and it offsets that with $85 billion in mandatory spending cuts. On net, the bill is forecasted to reduce the deficit by roughly $23 billion over the next ten years. ($2.3 billion annually is a paltry sum considering that the government spent that amount in the afternoon it took me to write this article.)

It’s also a short-term deal. The BBA is a joint resolution that only provides sequester relief through September 30, 2015, though it does so largely by establishing long term cuts to mandatory spending. Congress must still agree to and enact appropriations bills. Though Congress will have ample time to formulate its FY 2015 appropriations, it must scramble to agree to appropriations bills funding the remainder of FY 2014. The deadline for that effort is January 15th, both because it is the date that the current Continuing Resolution is due to expire and it is when next round of sequestration cuts are due to go into effect as mandated by the Budget Control Act.

Until the appropriations bills are enacted, most agency-level impacts will be difficult to assess–though we can see from the text of the BBA that user fees for U.S. Customs and Border Protection (CBP), the Transportation Security Administration (TSA) and the Pension Benefit Guaranty Corporation (PBGC) will all be raised, so we can probably divine some buttressing of leasing demand relating to those agencies. The BBA also provides significant relief to the Department of Defense (DoD). Absent this deal, the Pentagon would have seen a $20 billion funding reduction in fiscal 2014 relative to 2013. Due to the BBA, military funding will instead rise by about $2 billion in 2014 smoothing out a dip caused by the sequester.

“Sort Of”?

The BBA provides tremendous symbolic importance, limited budget relief and no long-term roadmap. So, it’s “sort of” impactful on federal leasing because it indicates bipartisan momentum, which has created optimism. With optimism and a little bit of budgeting runway, agencies are more likely to plan strategically for their space needs and possibly enter into longer-term lease commitments. Yet the basic structural defects in the federal budget persist, and they will only be resolved by a Grand Bargain of some type. That negotiation will be exceedingly difficult and I can’t predict if or when it will successfully conclude, but it is a prerequisite to sea-change improvement in the leasing market.

* National debt here is defined as gross debt, which is total debt held by the public ($12.3 trillion) plus intra-governmental holdings ($4.9 trillion) totaling $17.2 trillion. If you are a student of the national debt you’ll notice that publications alternately report gross debt and debt held by the public. I cite the gross figure in this case because that is the one that most closely corresponds to the debt ceiling established by Congress.