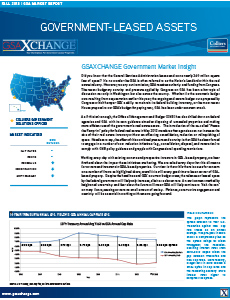

GSAXCHANGE, the investment sales arm of Colliers Government Solutions, has published its Fall 2013 “Government Market Insight” report, which includes an overview of sales activity and trends in the federal sector.

Despite the dire headlines and GSA’s current budget woes, the reliance on leased space by the federal government will likely only increase, albeit at a slower rate. Knowledgeable and experienced GSA investors recognize the “big picture” and continue to perceive investment in GSA-leased assets as a “safe-haven” for real estate investments. The federal footprint freeze and other factors notwithstanding, it’s still a favorable time to be an incumbent landlord and investor in GSA properties. We are still noticing that GSA investor appetite for properties with shorter lease term remaining continues to increase as investors seek higher yields by selectively targeting “value-add” opportunities in the GSA market. As such, for the time being, we expect sales of GSA properties in general to remain strong, and pricing for quality GSA properties with substantial lease term to remain very competitive.

Despite the dire headlines and GSA’s current budget woes, the reliance on leased space by the federal government will likely only increase, albeit at a slower rate. Knowledgeable and experienced GSA investors recognize the “big picture” and continue to perceive investment in GSA-leased assets as a “safe-haven” for real estate investments. The federal footprint freeze and other factors notwithstanding, it’s still a favorable time to be an incumbent landlord and investor in GSA properties. We are still noticing that GSA investor appetite for properties with shorter lease term remaining continues to increase as investors seek higher yields by selectively targeting “value-add” opportunities in the GSA market. As such, for the time being, we expect sales of GSA properties in general to remain strong, and pricing for quality GSA properties with substantial lease term to remain very competitive.

To read the full report, click here.