Our investment sales team was especially prolific last week, issuing two new reports on the Washington, DC area property market. The 2013 Year End Washington, DC Capital Markets Report noted that many primary and secondary markets around the country saw markedly increased sales volume and pricing in 2013, yet performance of the Washington, DC metro region lagged slightly. Much of this is attributed to on-going political uncertainty in Congress, public- and private-sector efforts to improve space utilization and tepid growth in office-using industries.

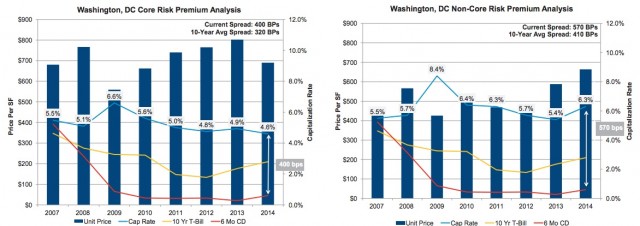

The team also produced a report entitled “Polar Vortex Not Chilling Pricing For Core Assets”. In it they observe that the Washington, DC market has been pricing initial capitalization rates for ‘core’ product at an average of 195 bps over 10-yr Treasuries. Yet, increasingly, yield oriented investors are measuring returns against alternative investments such as 6-month CDs and AAA corporate bonds. Relative to CDs, cap rates for core properties have compressed, now to a margin of about 400-450 bps.

As relates to core government-leased properties, this certainly rings true. As we noted in our profile of last year’s 1301 New York Avenue sale. That building, which is leased for 15 years to GSA, sold in the low 5% cap range. The nearby Bond Building was also leased to GSA for 15 years and it was also valued at a low 5% cap rate.

If you would like to read further, the 2013 year end market summary can be found here and the Polar Vortex report is here.