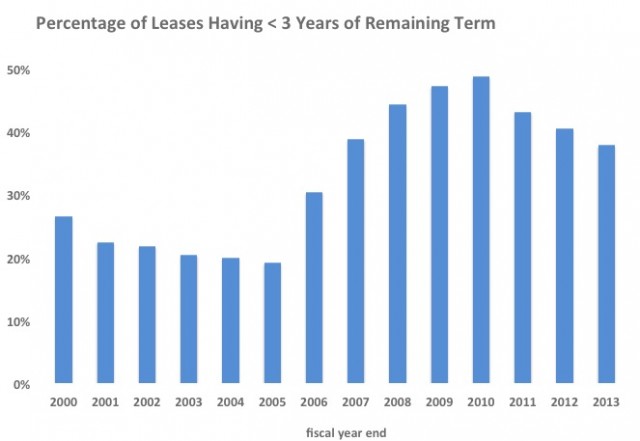

UPDATE: We updated this article the day after first publishing it in order to tune up our stats. The new graph (above) tracks the percentage of leases that have less than 3 years of remaining lease term as opposed to the number of leases that were executed for total terms of less than 3 years. We found that the latter stat is not so easy to coax reliably from GSA’s data. Nonetheless, the general trend remains the same and the text of the article is updated slightly to accommodate the new data.

In recent years lessors have become troubled by the fact that lease terms appear to be getting shorter and many new leases are short-term extensions or holdovers. The graph above demonstrates that these short-term leases (defined herein as those with less than three years of remaining term) comprised about 1/5 of GSA’s leased inventory from 2000 to 2005. But then the rate increased rapidly, more than doubling over just three years. Though the proportion of short-term leases has settled down slightly it is still almost twice as high as a decade ago.

We haven’t fully analyzed the causes of this but we can make some anecdotal observations. The first is that GSA in the mid-2000s was delivering a huge number of new lease-construct projects, many in response to government growth and new security concerns post-9/11. These new projects would frequently require short-term extensions of existing leases to sync up with the delivery dates. Yet, more often, GSA was simply finding itself unable to effectively execute the volume of leases it was faced with each year and the incidence of holdover increased dramatically. Both trends led to a greater volume of short-term extensions.

As the trend continued towards its peak in 2010, the deep recession and the resulting fiscal crises and political discord created such trepidation among tenant agencies that they were reluctant to enter into long-term lease contracts (especially ones that might require costly relocation). All the while, long term leases were burning off year by year, contributing to the number of leases with short remaining terms.

More recently we are beginning to see the proportion of short-term leases throttle down a bit. Frankly, this is the most surprising part of the trend because it doesn’t square with what we are seeing in the field, where the problem of short-term extensions seems as present as ever.

In any case, a new factor threatens to disrupt the trend towards improvement: the federal government’s push to improve space utilization through downsizing and consolidation. These are real estate endeavors that require considerable advance planning and the government doesn’t have enough lead-time to execute those plans. So we are already beginning to see requests for extensions to allow the government to indulge in methodical planning, then followed by full and open procurements to execute those plans.

Short-term leases will continue to prevail for some time, yet we can hope to eventually return to a time where leases with short remaining terms comprised just 1/5 of all leasing activity.

Note: In this analysis we only count leases that are at least 3,000 RSF in order to improve the focus on traditional leases, eliminating many TSA on-airport leases, storage leases, short-term census-related leases and other non-standard leases.