GSA’s lease selection process has made it a perpetual pioneer – pushing it to the fringe submarkets where office space is more generally available in abundant cheap supply. In the early 1990s the “fringe” was the East End, an area that thrives today but was once home to the city’s “red light” district. In the 2000s that fringe is even further east in the NoMA (North of Massachusetts Avenue) and Navy Yard submarkets. In fact, over the past few years about a million square feet of federal tenancy has shifted from the downtown core submarkets and into these eastern reaches of the city.

There are really two factors driving this change. The first is that the GSA has adopted a policy that it will include the entire Central Employment Area (CEA) in every lease competition. That means that a building in the nascent Navy Yard district competes equally with the vibrant, amenity-rich CBD. GSA’s qualitative analysis of buildings and locations is simply a pass-fail approach. If a building meets the basic technical requirements of the lease then it competes against other buildings purely on price. Lowest price wins. This type of evaluation is called lowest price technically acceptable and it is the predominant means by which GSA procures office space. Given the tremendous rent delta between core and fringe submarkets in the CEA, the incumbent building’s “relocation and replication” cost advantage is often overwhelmed and federal tenants are finding themselves (reluctantly) moving.

The second reason is more worrisome in the long run: Landlords may simply tell the government to get packin’.

When GSA manages large procurements (even renewals) it must first get approval from Congress. The approval comes in the form of a prospectus that, among other things, specifies the maximum rent GSA may pay to lease its space. GSA, with OMB oversight, establishes the maximum rent and Congress then approves it. The problem is that these prospectus rents have only increased $7.00 in eleven years, substantially less even than CPI growth.

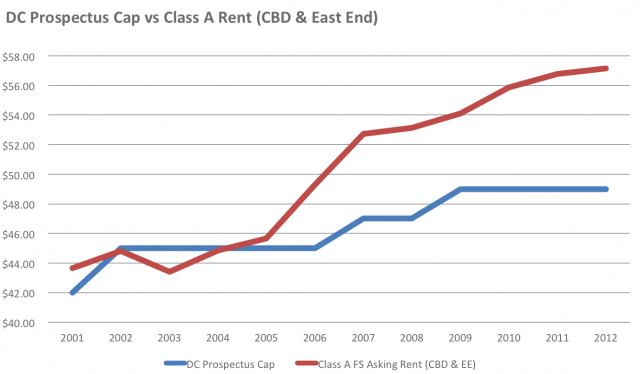

To illustrate this problem we created the graph shown above. The red line shows the average asking rent trend for Class A buildings located in the CBD and East End submarkets. The blue line shows the trend for the maximum prospectus rent approved each year by Congress.

You can pretty clearly see that prospectus rents and market rents traveled roughly in tandem from 2001-2005 and then market rents spiked, leaving the prospectus rents behind. Even as the nation lapsed into recession and asking rents began to level off, so did the prospectus trend. So, overall, the gap has widened every year.

What’s worse is that delta is really much wider than it looks because the prospectus rent is a flat rent and the market rent represents only the base year of an escalating lease structure. Therefore, for the market and prospectus trends to be in sync, the prospectus (blue) line should actually be above the market (red) line.

The current rent gap is substantial and this is where the prognosis for federal tenancy downtown looks grim, because we are just about at the “point of indifference” for many property owners. We are just about at the point at which the landlords ask GSA to leave because they can re-tenant their buildings at higher rents (and capitalize those higher rents to achieve greater value on the asset sale). Frankly, if the market weren’t so sluggish – if there were any real net demand – we would be at that point now.

Instead, for now, GSA survives by either moving to the low-cost fringe or by renewing under a bare bones lease structure that includes little in the way of capital contributions from property owners – whatever is required to make the deal work.