One of the great frustrations landlords encounter with GSA is the Government’s frequent and seemingly reflexive insistence on termination rights. We conducted a quick analysis of 1,165 procurements conducted by GSA in the past 7 years and found that in 70% of them GSA requested a termination right. GSA’s default expectation for most of these is that they will be structured as rolling rights providing GSA with an ongoing right to terminate, usually with just a few months’ notice. These rights aren’t necessarily situated near the expiration date either. Our analysis found that, on average, the requested firm term was just 57% of the total lease term (and, yes, our analysis didn’t count short-term extensions, nor any transactions relating to the decennial census).

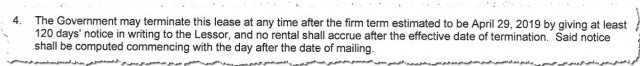

In certain cases, termination rights make a lot of sense for tenants – they are a great means by which to “sync” leases in instances where a broader consolidation is contemplated. They also provide flexibility when it’s known that an agency will move but the exact date is uncertain. But, still, why does GSA seek termination rights in nearly three-fourths of all leases? The answer is simple: GSA leases space on behalf of other federal agencies and their Occupancy Agreement (OA) with each tenant agency includes a standard clause that allows the agency to cancel its Agreement with GSA at any time with 120 days notice. That’s right, if the tenant agency cancels its OA then GSA is on the hook for the lease. So, GSA hedges its exposure by negotiating termination rights. The problem is that termination rights are more difficult to finance, and up-front costs (TIs and commissions) are generally amortized only over the firm term, front-loading costs. These factors serve to increase rents and decrease competition. From GSA’s standpoint, it’s not a big deal because those increased rents are passed through to the tenant agencies. The tenant agencies must value the flexibility but probably don’t truly understand the premium price the are paying. Agencies can agree to modify the OA to eliminate their right to terminate and seek a better rent but they rarely do. In any case, from a taxpayer perspective the whole thing doesn’t make much sense.

This is where the House Committee on Transportation and Infrastructure has missed a great opportunity to reduce federal real estate costs. In it’s October 2010 report, Stop Sitting on Our Assets: The Federal Government’s Misuse of Taxpayer-Owned Assets, the House Republican leadership outlined wide-ranging recommendations including a plan to reduce reliance on private leasing to house federal employees. The rationale was that leasing is more expensive than ownership. Often that is probably true, but the House is comparing apples and oranges because the Government’s risks under its prototypical lease structure are nothing like the inherent financial risks of property ownership. The prevalence of termination rights is one such example of the difference.

If the House wants to reduce real estate costs on a broad scale, it can do so with the stroke of a pen. All it needs to do is to better align GSA’s interest with those of its tenant agencies to dramatically reduce the number of portfolio termination rights. An improved, more financeable lease structure would result in an immediate and significant reduction in overall rent.